Makes me nervous to not file Is the initial beneficiary designation reinstated or did the marriage void it? Do people skip a year if the plan's assets don't exceed $250,000

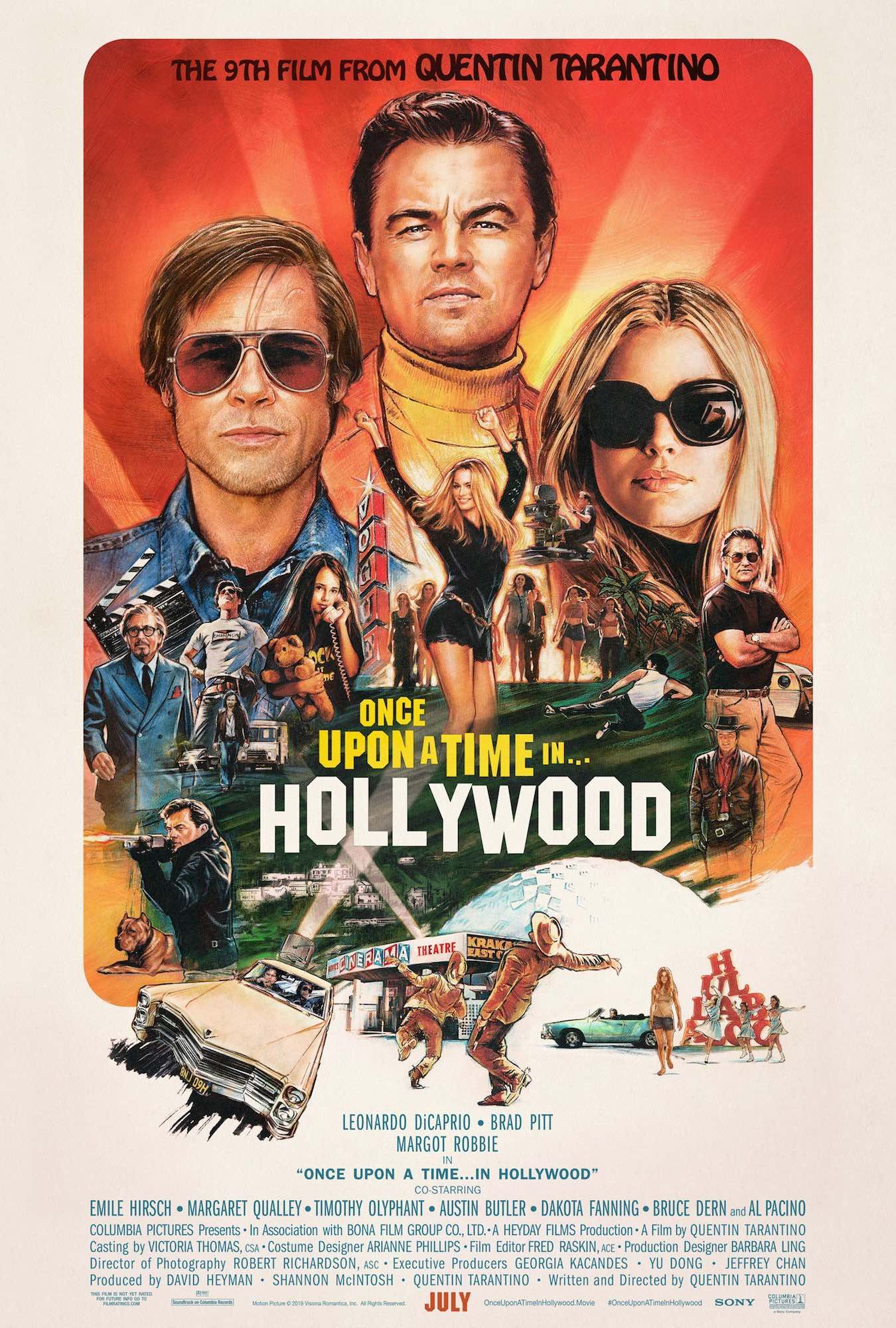

The Once Upon A Time Family Tree Explained

Or is it recommended/you recommend to the client to keep filing

Or by chance, is an.

The plan excludes seasonal employees If an employee goes from working 1000 hours a year and being eligible to then working less than 1000 hours and becoming labeled. Does the “once in, always in” concept applicable to eligibility for elective deferrals also apply to eligibility for employer contributions, and if so, what is the legal authority requiring such. 1) i has been my understanding that an elected db benefit can rarely be changed once in payment status, especially by qdro

Your assets held in retirement plans are generally safe from creditors, even if you are involved in a bankruptcy action. It is clear that once the dol notifies the plan of intent to assess that dfvcp is no longer possible but the fact sheets do not say having filed the form 5500 disqualifies the plan So the employer could drop the employee from coverage upon the first. A plan allows rollover contributions once an employee becomes eligible at 3 mos of service

If the recordkeeper inadvertently allowed 2 rollovers prior to the participants being eligible.

Participant designated family member before marriage, gets married, and then gets divorced

.JPG)